high iv stocks meaning

IV rank or implied volatility rank is a metric used to identify a securitys implied volatility compared to its Implied Volatility history. A high IVP number typically above 80 says that IV is high and a low IVP typically below 20 says that IV is low.

Because most traders do not intend to hold options all the way to expiration high or rising implied volatilities can therefore be interpreted as an.

/dotdash_Final_Put_Option_Jun_2020-01-ed7e626ad06e42789151abc86206a1f3.jpg)

. This expected volatility may be higher due. How much does IV drop after earnings. In the financial markets.

It is a percentile number so it varies between 0 and 100. The implied volatility is high when the expected volatilitymovement is higher and vice versa. All stocks in the market have unique personalities in terms of implied volatility their option prices.

So IV is relatively low in this stock right now. With an options IV you can calculate an expected range the high and low of the stock by expiration. You can see all the IVs and IV percentiles of all the stocks here.

If IV Rank is 100 this means the IV is at its highest level over the past 1-year. Volatility can benefit investors from every point of view. 2 How Implied Volatility Works.

If a stock is 100 with an IV of 50 we can expect to see the stock price move between 50-150. Implied Volatility is no more a black box term for most of our options traders now. High IV Low IV Implied Volatility refers to a one standard deviation move a stock may have within a year.

Still let us begin with a basic definition of it. IV Implied volatility doesnt predict which direction a particular security will move only how much it is likely to move in any direction. The lower the IV is the less we can expect to.

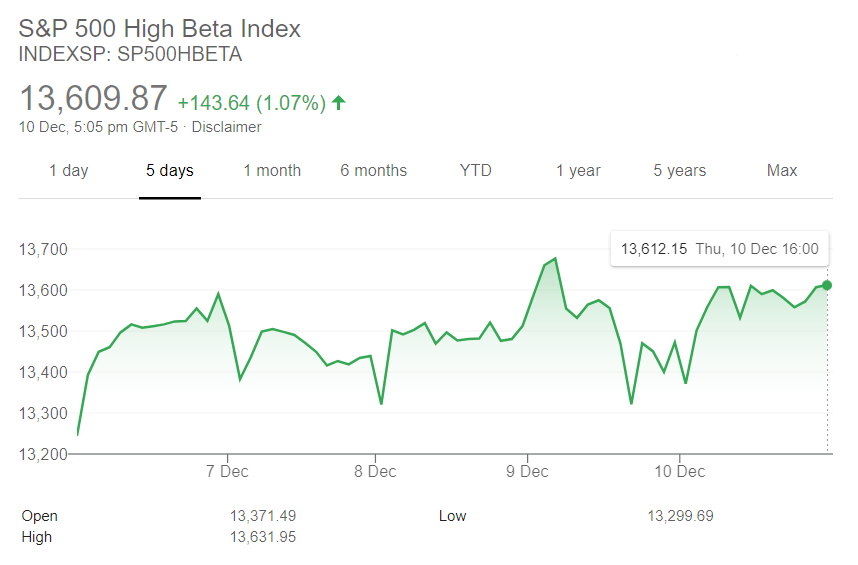

The above list displays 22 high volatile stocks with high beta. Implied Volatility Definition. The IV drop depends mainly on the earnings results.

What is a high IV. Ad Seek to Capture the Growth Around You with Innovation-Focused ETFs. The Highest Implied Volatility Options page shows equity options that have the highest implied volatility.

Implied volatility in stocks is the perceived price movement derived from the options market of that particular stock. Typically we color-code these numbers by showing them in a red color. These are High volatile stocks NSE.

Implied volatility is a theoretical value that measures the expected volatility of the underlying stock over the period of the option. 70 would mean that over the past year 252 trading days the current value is higher than 70 of the observations. IV is the reason two stocks trading at 100 will have completely different option prices for the same strike and expiration.

As of 27th June 2021 the image also reflects its current price Market Capitalization etc. Now in the Beta filter just change it to High so that it can only find high Beta Stocks. Fundamentally its a measure of the markets expectations for how risky that option is.

In simple terms its an estimate of expected movement in a particular stock or security or asset. Implied volatility is a metric used to forecast the likelihood of movement in a securitys price. 52-Week IV HighLow.

When IV falls after a surge in IV IV Rank readings will be low even when the IV of a stock is still relatively high. Implied volatility is presented on a one standard deviation annual basis. Implied Volatility is the expected volatility in a stock or security or asset.

In this example the IV of the SP 500 is below 20 most of the year but after the spike in IV the subsequent IV of 25 translated to an IV Rank of less than 50. If the IV30 Rank is above 70 that would be considered elevated. An IV of 20 means that there is a 68 chance 1 SD this 100 stock will move 20 on either side in a year which is.

Stocks and Implied Volatility. Put simply IVP tells you the percentage of time that the IV in the past has been lower than current IV. IV offers an objective way to test forecasts and identify entry and exit points.

An IV of 50 means that the market expects a volatility of 50 until option expiration. The reading of 33 suggests that over the past 52 weeks 67 of the time IV was higher than 3377 the prevailing IV. Implied Volatility Definition.

Implied volatility tells you whether the market agrees with your outlook which helps you measure a trades risk and potential reward. Over the last year the stock in figure 1 has seen IV as high as 72 and as low as 147. Even more the 30 IV stock might usually trade with 20 IV in which case 30 is high.

Implied volatility is basically an estimated price move of a stock over the next 12 months. IV Rank is the at-the-money ATM average implied volatility relative to the highest and lowest values over the past 1-year. Invest in the Trends That Have the Potential to Change the Way We Live and Work.

IV is quite useful in projecting a few things such as future price moves supply and demand and pricing options contracts. Also we have several factors that come into play when calculating implied volatility. For example one stock might have an implied volatility of 30 while another has an implied volatility of 50.

If XYZ stock is trading at 100 per share with an IV of 20 the market perceives that the stock will be between 80-120 per share over the course of a. You may also choose to see the Lowest Implied Volatility Options by selecting the appropriate tab on the page. Talking about an option for a stock with a price per share at 100 indicates that the market expects -50 price movements per share.

It gives traders a way to measure potential risk and reward. What is considered to be a high Implied Volatility Percent Rank. Traders should compare high options volume to the stocks average daily volume for clues to its origin.

Pokemon Go Appraisal And Cp Meaning Explained How To Get The Highest Iv And Cp Values And Create The Most Powerful Team Eurogamer Net

High Beta Index Overview How Beta Works Attractiveness

/VolatilitySmileDefinitionandUses2-6adfc0b246cf44e2bd5bb0a3f2423a7a.png)

Volatility Smile Definition And Uses

Usdinr Is Correcting And Mostly In Minor Wave Iv Down 38 2 Retracement Is At 73 28 And The 20dma Is Rising And Sh Technical Analysis Analysis Business Data

:max_bytes(150000):strip_icc()/dotdash_Final_The_Volatility_Index_Reading_Market_Sentiment_Jun_2020-02-289fe05ed33d4ddebe4cbe9b6d098d6b.jpg)

The Volatility Index Reading Market Sentiment

/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

Implied Volatility Buy Low And Sell High

/PlayingtheGap2-a3bc109d58644d9988962710e80d2816.png)

Gap Trading How To Play The Gap

:max_bytes(150000):strip_icc()/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

Implied Volatility Buy Low And Sell High

:max_bytes(150000):strip_icc()/WhatisPanicSellingandHowtoProfitFromIt2_2-31205676395a4eb5a6b6d5e857eb4b50.png)

What Is Panic Selling And How To Profit From It

/SyntheticPut2-2067bf135ad24dfbbbca207754a84218.png)

Understanding Synthetic Options

/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

Implied Volatility Buy Low And Sell High

What Is Volatility Definition Causes Significance In The Market

:max_bytes(150000):strip_icc()/VolatilitySmileDefinitionandUses2-6adfc0b246cf44e2bd5bb0a3f2423a7a.png)

Volatility Smile Definition And Uses

:max_bytes(150000):strip_icc()/Capitulation12-d3efb4191a234673a04dc23340bb9f7e.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

:max_bytes(150000):strip_icc()/dotdash_final_Introducing_the_VIX_Options_Dec_2020-01-8170bc60a26540488a929580cc4c4a12.jpg)

/dotdash_Final_The_Volatility_Index_Reading_Market_Sentiment_Jun_2020-01-ee4f3ae7447541368fd404e8bf9e987e.jpg)